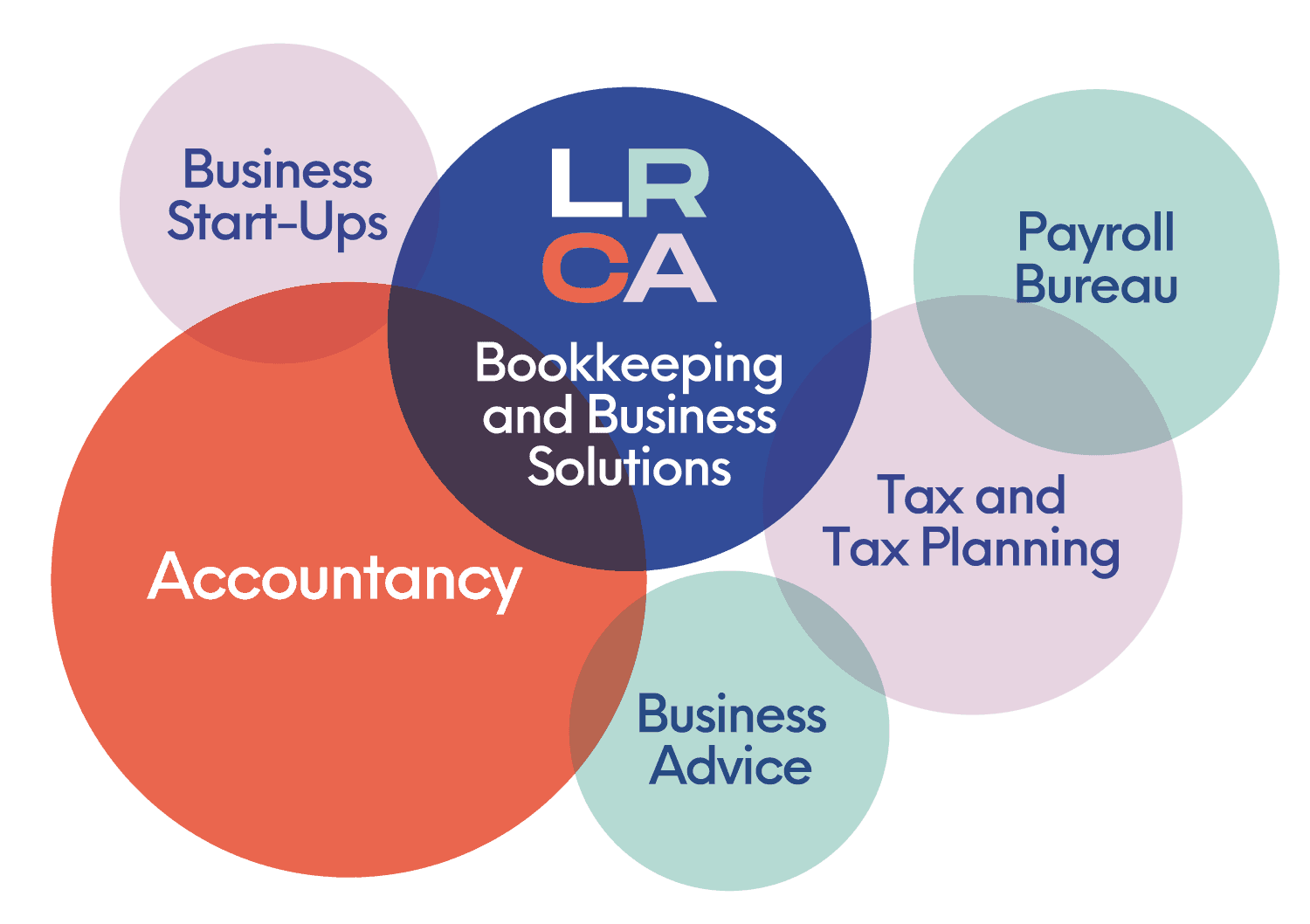

About Me

working together to achieve success

After working in professional practice for 13 years as a Chartered Accountant and in industry for 9 years as a Company Accountant and Finance Director, I founded LRCA Limited in 2019. LRCA Limited is an accountancy practice registered with and regulated by the Institute of Chartered Accountants (ICAEW).

By combining my professional accountancy skills and practical industry knowledge I offer a complete accountancy and business advisory service to my clients.

Services I Offer

Bookkeeping and Business Solutions

getting your books in order supports informed financial decisions

Effective bookkeeping is essential to any business.

By allowing me to take care of your bookkeeping it gives you more time to spend on developing and growing your business.

If you are happy to do your own bookkeeping I can provide training to ensure that the system is set up correctly and you have the support and knowledge to manage your accounts effectively.

Cloud accountancy software is far more than a bookkeeping system. It is a management tool and business solution.

In its simplist form:

- It offers more flexibility. You can track your sales and expenses from any PC, tablet or smartphone, as long as you have an internet connection.

- Information is available in real time, so you are better equipped to make financial decisions and have a clear overview of your current financial position.

- Data is stored in the cloud. Encryption and password protection ensures security of your data. No server or data backup is required and software upgrades are automatically installed.

As a business solution, the software can be integrated with third party apps to suit your business needs such as point-of-sale, e-commerce, stock management and payment methods.

I am a recognised advisor for both Xero and Quickbooks online. My aim is to help you develop a complete business solution by offering advice on the integration of apps to get the most out of your accountancy software.

Accountancy

making your accounts work for you

Whether you are a new business, contractor, freelancer, soletrader, partnership or a limited company, I have an accountancy service that is tailored to your needs.

With myself you can be confident that your accountancy solution is supported by a qualified chartered accountant. This means that it is supplemented by technical expertise and commercial experience when needed to ensure that your accounts are fully compliant with HMRC and Companies House.

Accounts are not just for compliance purposes. It is important to analyse the information strategically to manage the performance of your business and make financial decisions. I can advise and assist in interpreting this information.

Some business may require management accounts on a monthly or quarterly basis to support effective business planning. These can include budget and comparative figures and monitoring of areas such as cashflow and key performance ratios. These accounts and statistics will be tailored to your specific needs.

Accountancy services cover:

- Advising start up businesses

- Preparing accounts for soletrader and partnership businesses

- Preparing statutory accounts for companies

- Regular management accounts

- Day to day financial support and advice

Payroll Bureau

keeping your staff happy

Keeping up to date with changes in employment, pensions and taxation can be a challenge on any business. Outsourcing this burden allows you to focus your time on where it’s needed most.

I provide the typical payroll services of:

- Calculating pay, deductions, tax and national insurance contributions.

- Managing new starters and leavers.

- Filing real time information (RTI) with HMRC.

- Year end activities such as P60’s and P11D benefits and expenses.

- Performing auto-enrolment assessments, submitting pension contributions to your pension provider and ensuring compliance with the Pensions Regulator.

In addition I use payroll software with cloud integration which offers added benefits:

- In built data security, GDPR compliant portals and automatic backups for handling your highly sensitive and critical function data.

- An employer portal to access payroll reports and amounts due to HMRC.

- An employee portal and smartphone app to access payslips.

- Seamless annual leave management with leave requests instantly added to a company wide online leave calendar.

- HR integration with contracts and documents uploaded to the portal.

- Facility for clients to enter hours worked, additional pay and new starters direct into the system.

- Integration with Xero, Quickbooks Online, Sage One, plus others to minimise data entry.

Business Start-Ups

getting you started on the right track

The decision to start your own business is both exciting and daunting. You want to create a successful business but the initial emphasis is on keeping overheads low and doing as much as possible yourself.

For this reason many business start-ups delay seeking accountancy advice but it’s important to get off on the right track.

This is where my free, no obligation chat really helps. We can discuss your plans and if you want to proceed we can work together in determining how much you want to do yourself and where you need support.

I can support you in a number of ways:

- Prepare a business plan

- Help determine the best structure for your business, whether it’s a soletrader, partnership, limited liability partnership or limited company.

- Assist with company formation and secretarial duties.

- Register your new business with HMRC

- Establish professional relationships with banks, insurers, solicitors and financial services.

- Prepare cashflow projections and assess financial requirements.

- Prepare and submit finance applications.

- General bookkeeping and bookkeeping support.

- VAT

- Payroll and auto enrolment of pensions.

- Tax planning.

- Management accounts and annual accounts.

Business Advice

how a real business works

Having worked in industry I understand how a real business works. I can appreciate the demands of limited time and resources, particularly in a small business. I can offer help and advice with:

- The correct structure for your business

- Systems to approve efficiency and reduce costs

- Management accounts and analysis

- Forecasting and cash flow projections

- Access to finance and grants

Tax and Tax Planning

pay the right amount, but the minimal amount

Tax is complex and meeting all of HMRCs’ compliance requirements is essential, but we all work hard for our money and want to keep tax as low as possible.

Tax planning can minimise your personal and business tax burdens. This can include working with you to agree the most effective tax structure for your business or strategies that enable you to take best advantage of tax reliefs and allowances while ensuing rigorous compliance.

My services include:

- Self-employed tax

- Partnership tax

- Corporation tax

- VAT

- Research and Development (R&D) tax relief

- Construction industry tax deduction scheme (CIS)

LRCA Limited also offers a tax investigation package. For a small annual fee, you or your business can be protected from unwanted and unexpected professional fees to defend your position in the event that HMRC starts a compliance check.

You might be chosen for an enquiry due to the nature of your business, where you live, the property you rent out or perhaps because HMRC has decided to target your particular industry or profession. However, a proportion of enquiry cases are selected completely at random.

How I Work

a personal, tailored accountancy solution

The first step with any new potential client is a free, no obligation chat. By determining the size and stage of your business and identifying areas of required compliance I am able to offer you the services that your business needs. Due to the flexibility of cloud accounting software these required services can be incorporated into a cloud solution which provides additional business tools. Together we can create a package that combines the services and level of support you want.

Being a sole practitioner myself means that you can be assured that you will receive a personal service. You will receive the benefit of always dealing with a chartered accountant who has a full overview of your business. I am also connected with other financial partners. These include Chartered Financial Planners and Tax Investigation Specialists. Therefore, you can be confident that this gives me access to specialist advice and services where needed.

Featured Testimonials

Latest Updates

Get in Touch

Let’s have a chat and see how I can help